-

LONDON: Indian-Origin Teen In UK Gets “Life-Changing” Cancer Treatment - April 25, 2024

-

SILICON VALLEY: All About Pavan Davuluri, New Head Of Microsoft Windows - April 25, 2024

-

LONDON: UK’s India Gate To Commemorate Role Of Indian Soldiers From World Wars - April 24, 2024

-

HARARE: Shri Bramha Kumar appointed as the next Ambassador of India to the Republic of Zimbabwe - April 23, 2024

-

LONDON: Indian-Origin Principal Wins UK Legal Challenge Over School Prayer Ban - April 23, 2024

-

TORONTO: Indian-Origin Doctor Needs ₹ 2 Crore For Legal Fees. Elon Musk Responds - April 22, 2024

-

KINSHASA: India-Democratic Republic of Congo Foreign Office Consultations - April 21, 2024

-

LONDON: UK Court Allows Sale Of Nirav Modi’s Luxury London Apartment - April 21, 2024

-

TEHRAN: Travel advisory for Iran and Israel - April 20, 2024

-

LUXEMBOURG: Shri Saurabh Kumar concurrently accredited as the next Ambassador of India to the Grand Duchy of Luxembourg - April 20, 2024

GEORGETOWN: Indian company buys 1st million barrels of Guyanese crude from Hess

GEORGETOWN: The world’s third largest

importer of oil, India, has bought its first cargo of light sweet crude from

Guyana.

International news agency Reuters

on Wednesday reported from a source that the cargo was bought by HPCL-Mittal

Energy Ltd (HMEL), a joint venture between State-run Hindustan Petroleum Corp

and Indian steel tycoon LN Mittal.

The report states that HMEL operates a 226,000 barrel per day Bathinda refinery

in the northern state of Punjab.

Reuters reported that the one-million-barrel cargo of Guyana’s Liza light sweet

crude set sail from offshore Guyana on March 2 on the Marshall Islands-flagged

tanker Sea Garnet bound for India’s Mundra port, where it is set to arrive

around April 8. The cargo’s charterer is Trafigura, according to the Refinitiv

Eikon data.

Natural Resources Minister Vickram Bharrat told Reuters this month that while

he did not know the identity of the cargo’s ultimate buyer, the crude onboard

the Sea Garnet had been originally allocated to New York-based Hess Corp, one

of the companies producing crude in Guyana along with ExxonMobil Corp, and

delivered to Trafigura.

Commercial transaction

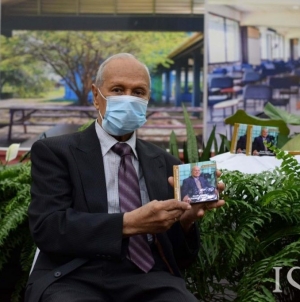

In fact, Indian High Commissioner to Guyana, Dr KJ Srinivasa told Guyana Times

that this was a commercial transaction between the companies involved, and as

such, they were not privy to the details.

However, he believes that the cargo was Hess’ quota that was bought by HMEL

from Trafigura. Reuters reported that Trafigura “declined to comment on

commercial matters” and Hess “did not immediately reply to a request for

comment”.

According to Dr Srinivasa, given the cargo size and the HMEL refinery’s

capacity, “this will be enough for them only for four days”.

Further, when asked whether there would be another purchase of oil from Guyana,

the Indian diplomat said: “These commercial transactions are always evolving…

We can’t comment from High Commission which transactions are happening right

now.”

Nevertheless, High Commissioner Srinivasa explained that this oil buy was part

of India’s call to all its refiners – both State-run and private.

“The Government of India has asked the refiners to speed up the diversification

of imports which will cut our dependence mainly from the Middle East and

through all the OPEC+ [Organisation of Petroleum Exporting Countries-Plus]

countries. So, basically, we’re trying to diversify and we’re trying to

rekindle our partnership with other countries,” he noted.

The Indian diplomat disclosed only recently his Government struck a big deal

with Mexico for a short-term oil contract to help offset its existing

high-priced long-term contracts. This is in addition to an existing “six

million-tonne” contract with Mexico.

In fact, it was reported earlier this month that apart from Mexico, India was

also in talks with Guyana for a short-term oil contract.

“You know, we are an energy-hungry nation. We import about 86 per cent of

crude… And obviously, your Liza oil – “light sweet crude” are the words used –

seems to be well suited for our refinery. We are working on various options

now,” he noted.

Dr Srinivasa further reminded that India had expressed interest to buy Guyana’s

share of oil through a Government-to-Government arrangement, which he pointed

out would cut out any handling or commission fee. However, these talks are

still ongoing.

India used to import a significant portion of its oil from Iran and Venezuela.

However, the sanctions imposed by the United States on these two nations has

resulted in a massive reduction of those imports.

“We stopped receiving crude imports from Venezuela for last three, four months

now. Every day, we used to get close to about 375,000 bpd from Venezuela,” he

noted.

According to the Reuters article, the OPEC’s share in India’s oil imports fell

to historic lows between April 2020 and January 2021 after the body took a

decision recently to extend production cuts through April.

Guyana, with US oil giant ExxonMobil as the operator, began producing oil on

December 20, 2019 in the Stabroek Block. Guyana’s oil revenues are being banked

in the New York Federal Reserve Bank, where it is earning interest.

To date, the country has received payments for five lifts of oil. The most

recent payment was made earlier this month for a 997, 420-barrel oil lift in

February from Liza Destiny. That lift was valued at US$61 million, taking the

total amount received to date for Guyana’s share of oil to US$246.5 million.

Inclusive of royalties, the total in the Natural Resource Fund account now

stands at US$267.6 million.

The Natural Resources Ministry reported that Guyana received its first payment

of US$54.9 million for an oil lift dated February 19, 2020. Guyana’s second

lift, on May 21, 2020, was valued at US$35 million. The third lift, which

occurred on August 9, 2020, was valued at US$46 million, while the fourth lift

occurred on December 9, 2020 and came in at US$49.4 million in value.