-

LONDON: Indian-Origin Teen In UK Gets “Life-Changing” Cancer Treatment - April 25, 2024

-

SILICON VALLEY: All About Pavan Davuluri, New Head Of Microsoft Windows - April 25, 2024

-

LONDON: UK’s India Gate To Commemorate Role Of Indian Soldiers From World Wars - April 24, 2024

-

HARARE: Shri Bramha Kumar appointed as the next Ambassador of India to the Republic of Zimbabwe - April 23, 2024

-

LONDON: Indian-Origin Principal Wins UK Legal Challenge Over School Prayer Ban - April 23, 2024

-

TORONTO: Indian-Origin Doctor Needs ₹ 2 Crore For Legal Fees. Elon Musk Responds - April 22, 2024

-

KINSHASA: India-Democratic Republic of Congo Foreign Office Consultations - April 21, 2024

-

LONDON: UK Court Allows Sale Of Nirav Modi’s Luxury London Apartment - April 21, 2024

-

TEHRAN: Travel advisory for Iran and Israel - April 20, 2024

-

LUXEMBOURG: Shri Saurabh Kumar concurrently accredited as the next Ambassador of India to the Grand Duchy of Luxembourg - April 20, 2024

GEORGETOWN: Bank of Baroda looking to expand operations in Guyana

GEORGETOWN: India-owned Bank of Baroda is

looking to expand its operations locally, a turnaround lauded by Finance

Minister, Dr Ashni Singh, since, only a few years ago, the bank was looking to

exit Guyana.

This revelation was made on Wednesday during a ceremony at the Arthur Chung

Conference

Centre (ACCC) to confirm Bank of

Baroda’s status as a mortgage lender. The bank’s Managing Director, Arun Gupta,

observed during his presentation that the bank has multiple branches in

countries all over the world, but not in Guyana.

“We are in the process of

considering expanding our product offerings. And we will be opening a few

branches in the near future. That proposal is also under consideration. The

Bank of Baroda is majority-owned by India,” Gupta said. “We have 10 branches in

the United Kingdom. We have branches in Belgium, Singapore, Dubai.

In African continent we have in Zambia, Kenya,

Uganda. (We have) branches in Australia, New Zealand, Fiji.

“So, it’s a very big bank, but in Guyana we are very small in size, just two

branches. But shortly we will be expanding that.”

It is a stunning turnaround, considering that the Bank of Baroda was on the

verge of exiting Guyana’s market back in 2018.

In his presentation during the event, Minister Singh lauded the bank for its decision

to maintain its presence in Guyana.

“I am delighted that we have

moved from a place where, just two years ago, the conversation was about

whether Bank of Baroda would be closing and withdrawing from Guyana. A bank,

mind you, that has been here since Guyana became independent.

“I am delighted that we have moved to a point where the bank is now firmly

present in Guyana, and is looking to expand its presence in Guyana, including

by introducing new products and engaging in new partnerships,” Minister Singh

said.

According to the Minister, the

Indian High Commission was integral in the bank’s decision to remain in Guyana.

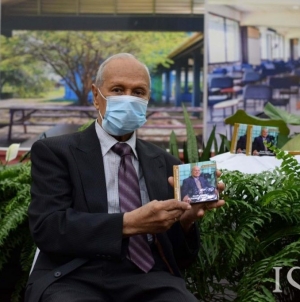

In fact, the event featured the presence of current High Commissioner of India

to Guyana, Dr KJ Srinivasa.

“We’re extremely pleased that the High Commission intervened when it did and

made the necessary interventions on how attractive Guyana is from the point of

view of potential growth opportunities, and that the senior management and head

office of the bank was persuaded to remain open in Guyana,” the Finance

Minister said.

With the signing of Wednesday’s

agreement, Bank of Baroda will now be able to provide mortgage financing to

homeowners by being designated as an approved Mortgage Finance Company in

keeping with Section 15 of the Income Tax Act, Cap 81:01.

It was only last week that the New Building Society (NBS), which is already

known for its low mortgage interest rates, announced a reduction in its

interest rates. These twin measures are expected to open up increased

opportunities for homeowners to get affordable mortgages.

NBS was also presented with approval to raise its loan ceiling from $12 million

to $15 million, in keeping with one of the measures outlined in the 2021 budget

by the People’s Progressive Party (PPP) Government.

The increase in the loan ceiling

is only one of several measures the Government is pursuing in a bid to

re-energise an economy stunned by the COVID-19 pandemic, while at the same time

presenting homeowners with more options in relation to borrowing funds.

Since coming to office, the Government has made it clear that it intends to

fulfill its manifesto promise to distribute 50,000 house lots over the next

five years. It had allocated $6 billion for enhancing infrastructure in existing

housing areas in the 2021 budget.

A significant sum has also been

set aside for improving water service and developing new wells.