-

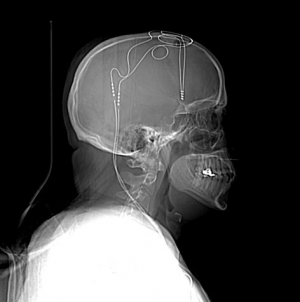

LONDON: Indian-Origin Teen In UK Gets “Life-Changing” Cancer Treatment - April 25, 2024

-

SILICON VALLEY: All About Pavan Davuluri, New Head Of Microsoft Windows - April 25, 2024

-

LONDON: UK’s India Gate To Commemorate Role Of Indian Soldiers From World Wars - April 24, 2024

-

HARARE: Shri Bramha Kumar appointed as the next Ambassador of India to the Republic of Zimbabwe - April 23, 2024

-

LONDON: Indian-Origin Principal Wins UK Legal Challenge Over School Prayer Ban - April 23, 2024

-

TORONTO: Indian-Origin Doctor Needs ₹ 2 Crore For Legal Fees. Elon Musk Responds - April 22, 2024

-

KINSHASA: India-Democratic Republic of Congo Foreign Office Consultations - April 21, 2024

-

LONDON: UK Court Allows Sale Of Nirav Modi’s Luxury London Apartment - April 21, 2024

-

TEHRAN: Travel advisory for Iran and Israel - April 20, 2024

-

LUXEMBOURG: Shri Saurabh Kumar concurrently accredited as the next Ambassador of India to the Grand Duchy of Luxembourg - April 20, 2024

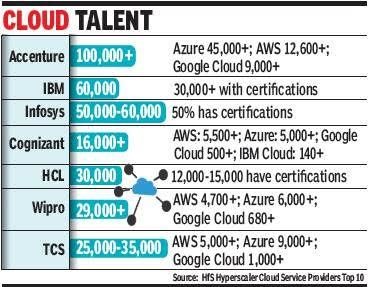

TOKYO: Accenture, IBM, Infy are top cloud service providers: HfS

TOKYO: US IT advisory HfS Research has

ranked Accenture, IBM, Infosys, Cognizant and HCL as the top 5 hyperscaler

cloud service providers. These are followed by Wipro, TCS, Capgemini, KPMG and

EY.

HfS Research defines hyperscaler cloud service providers as those bringing

global business solutions outsourcing and consulting capabilities to support

and enable organisations to migrate, adopt, and build cloud-native offerings.

These providers consult on platform re-architecture, application development,

data migration, and transitioning services from technology stacks into macro

and microservices hosted in a data centre on-premise, private cloud, public

cloud (hyperscale), or any combination.

Given the massive movement to the

cloud now, these cloud service providers are becoming invaluable. HfS ranked

the cloud providers across execution, innovation, and voice of the customer

criteria.

The research is the result of data collected last year through provider RFIs

(request for information), structured briefings, client reference interviews,

and from publicly available information sources. This information is

supplemented by key findings from a large G2000 survey of enterprise leaders.

The report analysed service providers with a minimum of 10,000 cloud

professionals, services across the cloud services value stream, and scale to

provide global and cross industry services.

Accenture tops the list with over 1 lakh cloud professionals. It had approximately

$12 billion in cloud revenue in 2020. Last year, it set up the Accenture Cloud

First initiative with a $3 billion investment over three years to help clients

become `cloud first’ businesses. The report says it has invested considerably

in evolving innovative cloud migration and management platforms and solutions.

HfS’s Joel Martin, research VP

for cloud strategies, and Martin Gabriel, associate director of research, noted

that rebadging discrete solutions into a “cloud-ready” offering isn’t enough.

“Service providers must have a compelling story for both technology and

business leaders on how their solutions have sustainable impact and meet robust

security and governance requirements while accelerating a shift to becoming

cloud native. Worth noting is that business leaders are more likely to consider

traditional technology outsourcers as they are still focused on costs and

efficiencies, while technology leaders look to GBS (global business services)

to provide business context to the cloud. The winning hyperscaler service

providers will offer both,” they said. They said orchestration of multiple

applications, databases, and processes across on-premise, hybrid, and public

cloud is an architectural issue first. “DevSecOps, testing, quality assurance,

and CI/CD managers are all important, but enterprises and service providers

must start with the architecture in place and a vision for change,” they said.

IBM, which is ranked second and

which counts Etihad Airways, Thomson Reuters, Phillips Carbon Black as

customers, acquired Red Hat for $34 billion in 2018, which significantly

strengthened its multi-cloud capabilities. HfS estimates it has over 60,000

cloud professionals. “IBM must convince customers that Red Hat’s OpenStack and

Garage Methods solutions don’t lock you into IBM, but rather provide a rich

tapestry for multi-cloud orchestration,” Martin and Gabriel wrote.

Infosys, which counts Dairy Farm,

Australian Open, DNB ASA as customers, trains 5,000 hyperscale professionals

each month, shows HfS’s study. HFS estimates it has 50,000–60,000 cloud

professionals and half of them hold at least one cloud certification. Last

year, Infosys launched Infosys Cobalt that provided access to a catalogue of

over 15,000 assets to help businesses leverage the potential of the cloud

ecosystem. It also has the Polycloud Platform to manage hybrid cloud

infrastructure.